I hardly pay attention to the news about oil. All it ever seems to be is "Oil Prices at Record High". But I would really like to UNDERSTAND what is going on and how we can best approach a solution.

In my very brief research on the subject, I learned:

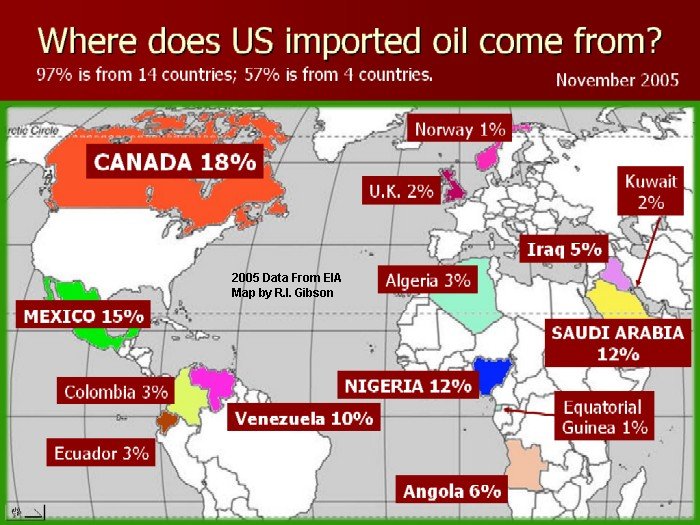

Most of our (U.S.) oil comes from the U.S. (41%), North America and the Western Hemisphere (in that order)

Most of the world's oil comes from Saudi Arabia.

Most of the world's oil comes from Saudi Arabia.The Middle East has, by far, the largest oil reserves.

Hence why we are so interested in the Middle East (besides the spread of democracy and Christianity). Because even though we don't YET consume very much of their oil, we might need to. Soon.

However, you have to factor in developing nations like India and China. Their oil consumption is increasing exponentially.

I wanted to exhalt the E.U. on its investment in renewable energy resources, but apparently they have fallen short of their goals.

Of course, as a tree-hugger, I don't want to drill for more U.S. oil. I would much rather everyone concentrate on alternatives to oil and I think one of the best ways to urge consumers and industry to do that is to keep the price of oil high. People seem to pay attention to issues when they hit their pocketbook. But then again, I don't want the oil industries to realize absurd profits. And I don't want the U.S. to become even more dependent on foreign oil. And, honestly, I don't want to personally take the hit in resulting increases in food and other prices.

So, looking into WHY oil prices are so high, it seems it's not just the law of supply and demand--it has to do with investors trading commodity futures (as well as the falling value of the Dollar). Their investments in oil have inflated the price. So how is drilling for more oil (which, btw, is apparently only going to keep the U.S. running another couple of years) going to help solve that? Sounds to me like there needs to be regulations regarding that type of investment. Because, much like the housing bubble, it's going to burst and I can't wait to see what bailout the U.S. government will offer up then!

All this being said, I am still extremely ignorant of all the factors at play here, so anyone who knows more is more than welcome to comment/criticize!

2 comments:

Presuming this posting sprang from my remark last night about the Colorado Public Radio program which intimated that much of our state's gasoline was produced in-state, I did a little research of my own.

It turns out that Colorado produces 23 million barrels of oil a year (half from Weld County alone). Although a barrel contains 42 gallons, the refining process produces only 19.5 gallons

of gasoline (plus useful byproducts such as heating oil). Thus, Colorado can produce roughly 448 million gallons of gasoline.

However, Coloradans consume 2.3 billion gallons of gasoline each year. Thus, we can say that Colorado produces approximately 20% of the gasoline consumed in state.

Q.E.D.

You hit it on the head regarding the "futures" traders. The minute the price of the barrels jumps, my local gas stations prices go up (one day 10 cents a gallon while I was at work!). However, notice when the barrel price goes down what the gas stations say. "We bought the gas yesterday at the higher price." A bunch of BS IMHO.

This will probably be a good thing for the planet in the long run.

I also had a discussion with a friend at work that this may actually help the American family. People are staying home more and eating together etc. Time will tell.

Post a Comment